The Drivers behind Asia’s online luxury consumption boom

The Drivers behind Asia’s online luxury consumption boom

Online retail for Asia’s Luxury market grows as Asian consumers become increasingly tech savvy and brands improve their online shopping experience. Agility Research & Strategy profiles the Asian E-Commerce Shopper from 4 key markets – China, Hong Kong, Singapore and Indonesia.

These are recent research findings extracted from the Agility Affluent Insights study conducted by Agility Research & Strategy in June 2014, administered online among 1500 (equally distributed) affluent respondents in 5 countries – China, Hong Kong, Singapore, Indonesia and the US.

About Asia’s E-Commerce Shoppers

- The majority of Asian E-Commerce Shoppers are Gen AAA (Aspirational, Ambitious, and Affluent) shoppers aged 18-34 years (58%). There is an approximate equal gender distribution, with 51% females and 49% males.

- Asian E-Commerce Shoppers occupy a variety of sectors, from Vice President and Director roles in China (25%), Professionals in Hong Kong (23%), and Mid to High level Managers in Singapore (31%) to entrepreneurs in Indonesia (23%).

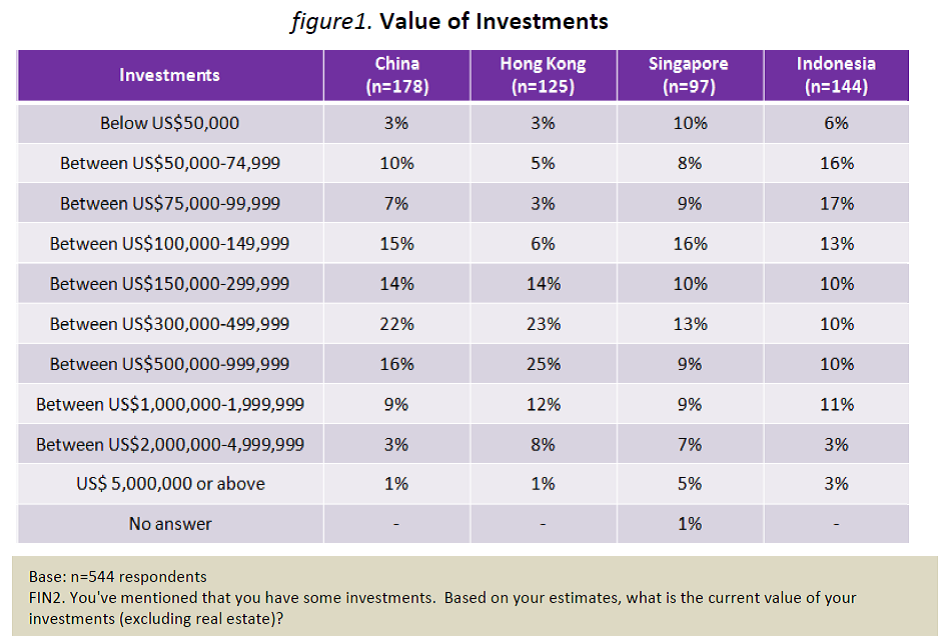

- Of the Asian E-Commerce Shoppers who invest, 32% have investments worth more than US$500,000, with some variance by country (figure 1).

Base: n=544 respondents

FIN2. You’ve mentioned that you have some investments. Based on your estimates, what is the current value of your investments (excluding real estate)?

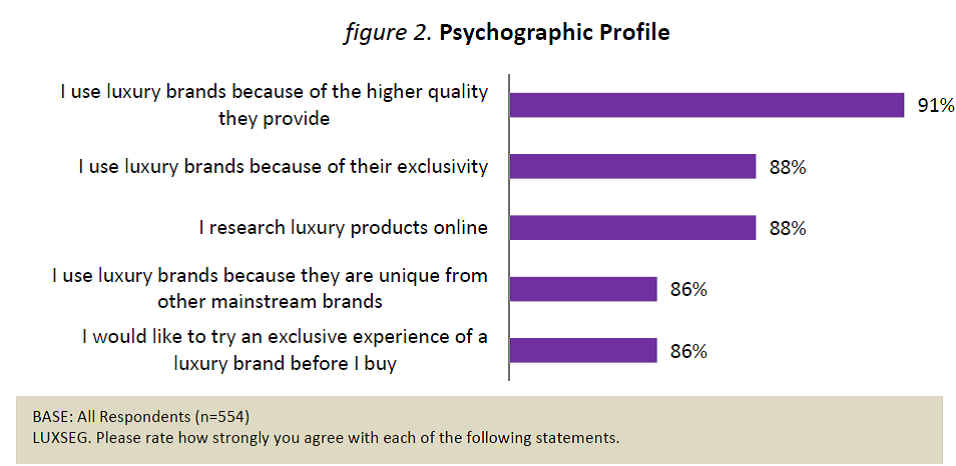

- The Asian E-Commerce Shopper values quality, exclusivity & uniqueness. They research online, and are also looking for a brand experience (Figure 2).

Key Insights from Agility Research & Strategy

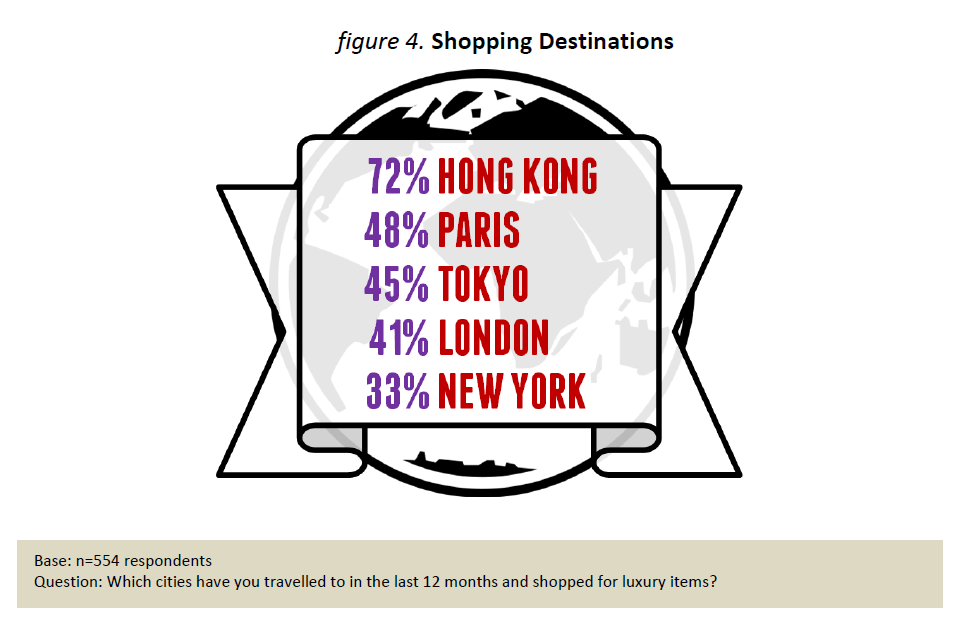

- Asian E-Commerce Shoppers do not restrict themselves to one channel; they may embrace online shopping (Figure 3), but also patronize brick & mortar brands in various countries (Figure 4)

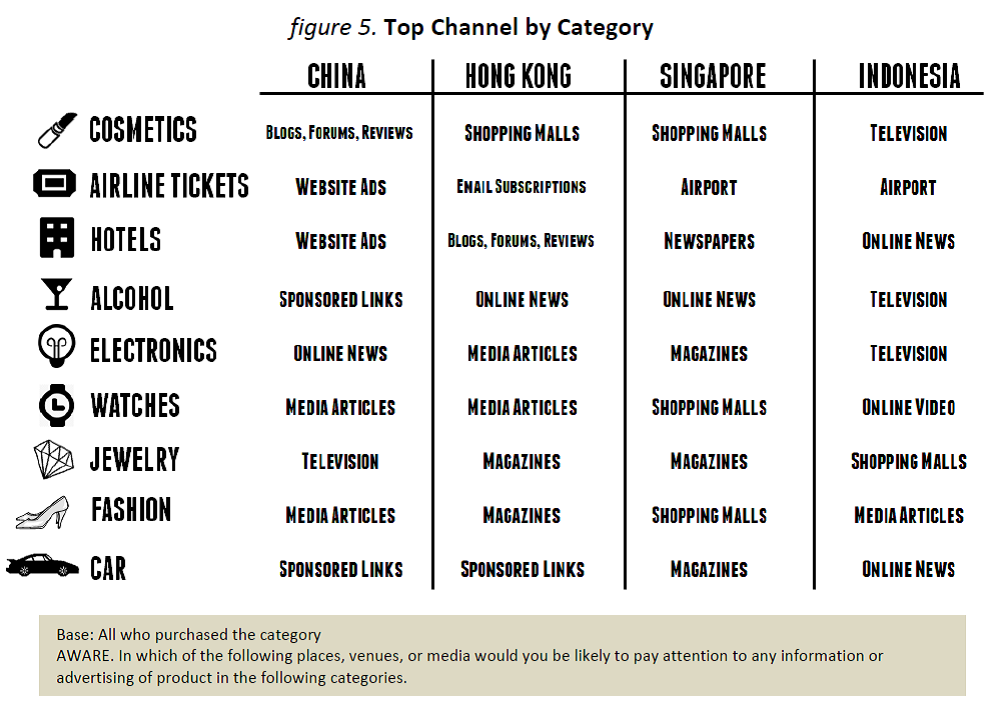

- Asian shoppers prefer specialized channels, consulting different sources for various types of purchases. The top channel for each category (figure 5) is as follow.

Top 3 Recommendations for Brands & Online Retailers

- Address the key concerns of your shoppers. An overwhelming majority of respondents indicated that they look for factors such as quality, exclusivity, uniqueness, and a brand experience. Given the competitiveness of the online retail landscape, brands may have to consider these as fundamental requirements to fulfil.

- Implement a mixed-model strategy. Shoppers buy both online and offline, and may research on the net or treat shops as showcases. Brands should consider virtual and real stores as complementary, and implement policies that utilise both to facilitate the shopping experience; e.g. allowing online purchases to be picked up, exchanged or returned in real stores.

Agility Research & Strategy is Asia’s fastest growing research company, ranked globally as a Top 10 research firm in the Luxury and Premium brand research space. As Agency of the Year nominee and with over 30 years combined experience in understanding the Affluent consumer, we are truly Fluent on the Affluent™. We partner with leading brands to provide actionable insights through a suite of data, research and intelligence solutions to boost their market share.

AFFLUENTIAL ™, the World’s first Global Consumer Intelligence portal, powered by Agility is a comprehensive platform for brands looking for intelligence on Affluent consumers across categories in more than 20 key economies including the United States, Europe and Asia Pacific.

For Press & Media Inquiries

Please contact:

Jason Ventura

Main: (65) 6396 6832

Fax: (65) 6396 6583

Email: jason@agility-research.com