Developing Countries, Emerging Luxury Markets

With an increase in GDP comes an increase in the population of affluent consumers who are becoming more confident of the disposable income they will have to spend on purchasing goods and attaining one of a kind experiences. This translates into new opportunities and new markets for brands to explore.

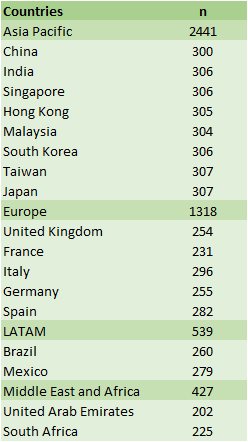

From a recent research by Agility Research & Strategy, carried out to take a snapshot of luxury and travel trends and behaviors in 17 countries around the world (outlined in figure 1), we can indeed see that affluent consumers in 6 developing countries – China, India, Malaysia, Brazil, Mexico, and South Africa – have developed a taste for luxurious goods and travel.

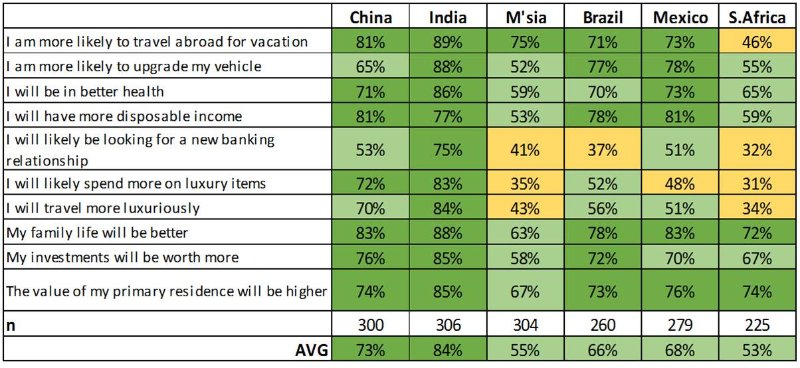

In the next 12 months, the majority of affluent people in all countries except for South Africa believe that they will more likely travel abroad for vacation. Geographic distance from the rest of the world might have affected the affluent South Africans’ aspiration to travel abroad.

As for spending more on luxury items, the 6 countries are split on the level of likeliness; the Chinese and Indians are the most likely to spend more on luxury, while the Brazilians and South Africans are the least likely. In fact, across all metrics, the affluent in these two Asian giants are generally the ones with the highest confidence about their future spending, when compared to the other 4 developing markets.

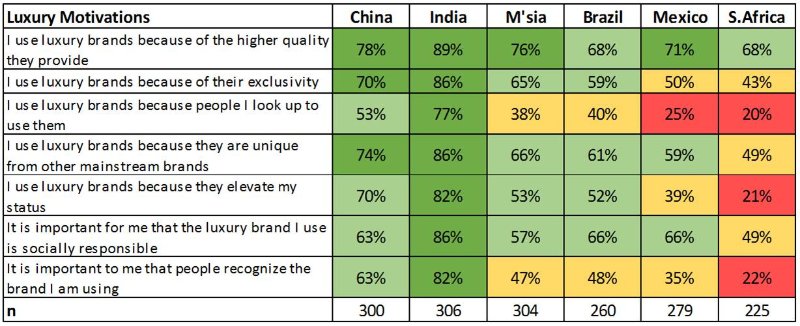

Why would one purchase luxury items? Across all countries, higher quality seems to be the most popular luxury motivation, followed by their uniqueness from mainstream brands. Interestingly, many of these consumers also find brands’ social responsibility to be an important factor. It is especially interesting when considering that many fashion and accessories brands produce their apparel in the developing countries where these new affluent consumers live.

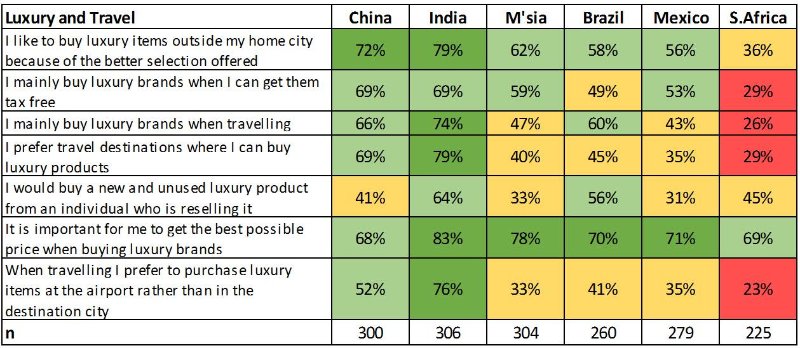

Do these affluent consumers purchase luxury goods during travel? The likeliness of purchase depends on where they come from. Chinese and Indians are again the most likely to mainly buy luxury brands while travelling – closely tailed by Brazilians, and to prefer destinations where they can buy luxury products. South Africa is again the country with the least likeliness in many metrics.

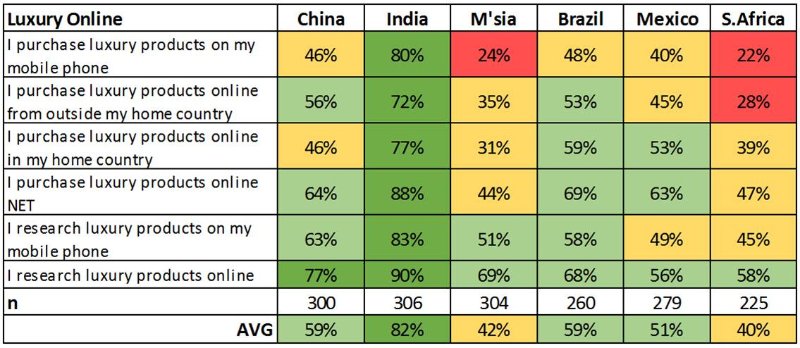

As for online luxury purchases, Brazilians and Mexicans are almost as likely as the Chinese and Indians to do so online. Moreover, Indians are the most likely to purchase luxury products on their mobile phone compared to the rest, with 4 out of 5 of them claiming so in our research.

The good news is that internet is consistently a popular source of awareness for luxury brands across all 6 countries. This further implies that even though planned luxury purchase is not consistent across these countries, both at home and elsewhere, many are curious about luxury and are actively researching about luxury goods and brands online.

It might be irresponsible to completely attribute the higher luxury aspirations in China and India to more frequent shopping rituals found in Chinese and Indian societies, especially among the elite. There is simply not enough evidence to support this proposition. It is still safe, however, to probe into the external variables which might have affected this disparity. Macroeconomic influences might have been one major contributor, currencies and exchange rates are one, also we see South Africa with a stagnating economy and a higher luxury tax rate has been implemented in Malaysia.

The other likely factor is that the luxury sector has not done its best to strengthen its presence, market its goods and create luxury markets in Mexico, Brazil, and especially South Africa, where the likeliness of luxury aspiration is consistently low across many metrics. There is a challenge that comes with the opportunities presented.

How can luxury brands and media promote luxury goods in these developing countries? How can they localize their products and experiences to attract consumers and make luxury something to aspire to? More insights and data, both quantitative and qualitative, are needed to answer these questions.

Agility Research & Strategy consultants are on hand to assist brands understand the consumer profiles in these countries better and to help brands maximize their opportunities and anticipate their challenges.

Previous Post

Previous Post