Hong Kong’s Hurdles & Opportunities

| Hong Kong, this bustling metropolis, is now in a transition period, facing both challenges and opportunities which will redesign the future of the city in the years to come.

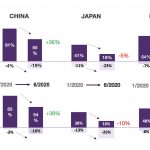

This is not new, Hong Kong has always thrived on change. The city has been able to reinvent itself previously. From its start as a trading port and gateway to China, the city evolved to become one of the most important global financial centers and tourist destinations. Its strength derived from being able to straddle two worlds: an open and International city, yet fully able to leverage China as one of its growth engines. The past two years have brought profound challenges to its economic model. The Hong Kong luxury retail scene has suffered from both the protests in 2019 and the recent Covid-19 crisis, both resulting in a steep decline of inbound travelers. As a result, several global and local brands are adjusting their store network strategy to serve the local market, rather than Chinese tourists. Lower tourist arrivals have hit the tourism and entertainment industry hard. While travel will resume at some point in the future, for now the economy will need to rely on local affluent consumers spending power and captive wealth from travel budgets which are not being spent. Hong Kong Local Affluent And HNW Consumers Hong Kong GDP per-capita is one of the highest in the world, at USD 48,000. The city is home to a large group of affluent and HNW individuals, sophisticated consumers of luxury products and experiences. Despite their wealth, they are not immune to the effect of the Covid-19 on the overall economy. Our TrendLens 2020 study has investigated how the current situation has changed their mindset, priorities and outlook for the future. Here is an extract with some interesting insights. A Gender And Wealth Divide Affluent Hong Kong consumers are still positive about their overall economic well-being in the next 12 months. Our data shows that men are more optimistic than women when looking at their future, with 45% of them believing that their economic well-being will increase in the next year, versus only 31% of women believing so. We believe the buoyant stock market and many recent listings is fueling some of this optimism. The divide is even more apparent when asked if they expect their disposable income to go up, with 51% of men believing their income will increase, versus only 33% of women believing the same. This translates in women having a lower propensity to spend on luxury products and experiences, with 42% of Hong Kong affluent women expecting to decrease their luxury purchases vs only 21% of men. The same divide is clearly visible across wealth levels, with 43% of HNWIs believing their economic well-being will increase in the future, versus only 35% of affluent consumers who believe the same. This divide will have important implications for luxury brands: our data says that luxury categories for men, like watches for example, will recover faster than categories which predominantly cater to women. The same is true for luxury brands targeting HNWIs, who show higher propensity to consume than affluent consumers. |

| TrendLens™ 2020

TrendLens™ 2020 is a complete insights and research program designed for marketing and insights teams and C-level executives of luxury brands in fashion, beauty, watches and jewelry, premium wine & spirits and travel, to understand the latest trends on affluent and HNW consumers, covering key global markets, including China, South Korea, Japan, India, Hong Kong, Singapore, Malaysia, Indonesia and the United States. The insights presented above are an excerpt from our latest TrendLens™ 2020 Wave 2 study, fielded in June 2020, interviewing over 4,500 affluent and HNWI individuals across key markets. To qualify, respondents earn a minimum AHHI of USD 150,000+, or equivalent local currency amount, with a significant proportion of HNW millionaires with a minimum 1 million US dollars in assets under management (excluding their residence). How Can Agility Help? Agility has been working with leading luxury and premium brands to understand and win wallet share from affluent consumers for over a decade. We help brands across a broad set of challenges and opportunities that lie ahead in this post-Covid world. Contact jason@agility-research.com to schedule a call with a consultant in your market to share more about our work and case studies. |

|

|

|

| Agility the news: This Tuesday our managing director Amrita Banta shared Agility’s view on the luxury sector rebounding across APAC at Channel News Asia. |

|

|

|

| To receive the full newsletter, enter your details below: |

Previous Post

Previous Post